Course Design By

Nasscom & Wipro

Set up full financial accounting in SAP Certification, including company codes, chart of accounts, and fiscal year settings

Build and organize controlling structures, like cost centers, profit centers, and internal orders

Configure the asset accounting system to handle depreciation and asset transfers

Use SAP reporting tools to create clear and useful financial reports and analyses

Connect the FI/CO modules with other SAP modules like Materials Management (MM), Sales & Distribution (SD), and Human Resources (HR)

Setting up key structures like company codes and business areas

Creating and organizing the chart of accounts and general ledger (GL) data

Setting up document types and number ranges for financial entries.

Configuring tax settings and tools for legal reporting

Designing cost center and profit center structures

Configuring internal orders to track project spending

Setting up product costing and activity-based costing

Helping with budget planning and checking for spending differences (variances)

Setting up asset classes and depreciation rules

Automating depreciation calculations

Managing asset purchases, transfers, and disposals

Building standard financial reports and statements

Using real-time reporting tools with SAP S/4HANA

Enabling drill-down reports to see details behind the numbers

A strong course should teach you everything needed to work in SAP FICO, including:

Basics of SAP ERP and how to use it

Full Financial Accounting (FI) setup and configuration

Controlling (CO) module design and processes

Key features of SAP S/4HANA Finance and the Universal Journal.

You learn best by doing. A good course will give you:

Access to a live SAP system for real practice

Full end-to-end scenarios to work through

Exercises that simulate real business processes

Full FI/CO implementation projects

Simulations of month-end and year-end closings

Building financial reports and dashboards

Hands-on integration testing

Experienced SAP FICO consultants

People whove worked on multiple real projects

Able to share practical tips and real case studies

Anyone with a degree can join. But some backgrounds give you a helpful head start:

A bachelors degree in any subject

Studies in finance, accounting, commerce, or business administration are a plus

MBA graduates who want to specialize in ERP systems

Fresh graduates who have strong thinking and analysis skills

Finance and accounting professionals who want to work with SAP

IT professionals interested in moving to functional (non-coding) roles

A basic understanding of accounting

Strong logical thinking and problem-solving skills

Clear communication skills to work with clients and teams

Good attention to detail for accurate SAP configuration

Knowing how to use a computer and basic software

Understanding how businesses work

Being familiar with Microsoft Office, especially Excel

What SAP is and how it works

Overview of SAP modules and how they connect

Using SAP GUI (interface) and key transaction codes

Understanding system setup (landscapes, clients)

Managing users and setting authorizations

How S/4HANA is different from earlier versions

Key concept: Universal Journal

Using SAP Fiori apps for finance tasks

Real-time reporting and analytics features

What to know when moving from ECC to S/4HANA

Setting up company codes and business areas

Defining fiscal year and posting periods

Creating credit control and financial areas

Enabling document splitting for better reporting

Creating and managing a chart of accounts

GL master data setup

Configuring document types and number ranges

Using posting keys and field settings

Setting up automatic account postings

Vendor master data configuration

Payment terms and discounts setup

Processing and verifying vendor invoices

Running payment programs

Reconciliation and vendor reporting

Customer master data setup

Credit limit and risk management

Creating and managing customer invoices

Setting up and running the dunning program

Collection reports and customer analysis

Creating asset classes and layout

Setting up depreciation areas

Managing asset numbers and bulk changes

Using Asset Explorer for asset info

Configuring depreciation keys and formulas

Managing useful life and scrap values

Handling special and unplanned depreciation

Posting periods and rules for depreciation

Using parallel accounting (e.g., IFRS compliance)

Asset purchases (with or without vendors)

Transferring assets between locations or companies

Retiring or scrapping old assets

Bulk asset changes and year-end steps

Connecting the asset module with other SAP areas

Setting up the controlling area

Creating cost centers and profit centers

Managing internal orders

Setting activity types and measurement keys

Organizing cost center data and hierarchies

Allocating primary and secondary costs

Setting up planning and budgeting

Analyzing variances and costs

Creating and categorizing orders

Managing budgets and availability checks

Settling internal order costs

Generating reports for internal order tracking

Building profit center structures

Setting internal billing and transfer pricing

Planning and reporting by profit center

Using assessments and distributions

Linking with profitability analysis

Global Job Opportunities: When you complete the SAP FICO course then this may open the doors to global job opportunities. So many of the multinational companies are actively looking for SAP FICO professionals who are eligible to work on international projects. So if you are from Mumbai or looking to relocate abroad, such as Singapore, Dubai, London, and the United States, there are various opportunities for the same. Also, the demand for remote SAP consultants is growing, offering flexible work options across different time zones.

Industry Diversity: SAP FICO professionals are in demand across almost every major industry. Manufacturing companies depend on cost accounting and financial integration. As well as Banks and financial institutions need SAP FICO expertise for risk management, compliance, and regulatory reporting. Well, in retail and e-commerce, these professionals handle inventory accounting and profitability analysis.

Career Progression Path: If you are looking to make your career in SAP FICO, this offers a clear path. Many of the professionals begin their careers as Junior SAP FICO Consultants and move into Senior Consultant roles within three to five years. With more experience, you can move to the advanced positions such as Lead Consultant or Solution Architect. This may include more responsibility, and you have to guide your project teams.

Entrepreneurial Opportunities: Taking just a course from the Best SAP FICO Training institute in Mumbai is not enough and will not prepare you for employment. This may also equip you to become an independent consultancy as well as an entrepreneur. So many of the professionals nowadays start their own SAP consultancy firms as well as offer services such as system implementation, optimization, and user training.

If you're a fresh graduate, you can earn 4 to 7 lakhs per year.

With 12 years of experience, the salary can grow to 7 to 12 lakhs per year.

With 3 to 5 years of experience, your salary may be between 12 to 22 lakhs per year.

If you learn special skills like S/4 HANA or work in a specific industry, you can earn 18 to 30 lakhs per year.

If you lead a team or manage big projects, your salary can be 22 to 40 lakhs per year.

After 8+ years of experience and team management, you can earn 35 to 60 lakhs per year.

If you work as a freelancer, you can charge 3,000 to 12,000 per hour.

With long-term contracts, you might earn 40 to 80 lakhs per year.

Big companies like TCS, Infosys, Wipro, Accenture, and IBM hire FICO consultants to help their clients.

There are many companies, such as Tata Motors, Mahindra, Bajaj, and L&T, that may need SAP FICO experts who can help in managing the costs as well as profits.

Banks and insurance companies can use the SAP FICO for the financial reports, manage the risks, as well as follow the rules.

Companies like Sun Pharma and Dr. Reddys need FICO to track costs and stay compliant with regulations.

These companies need special FICO setups to handle project costs and government reporting.

Shows you understand SAP Financial and Controlling systems and can work on real projects.

Proves you know the latest tools like Universal Journal, real-time reports, and Fiori apps.

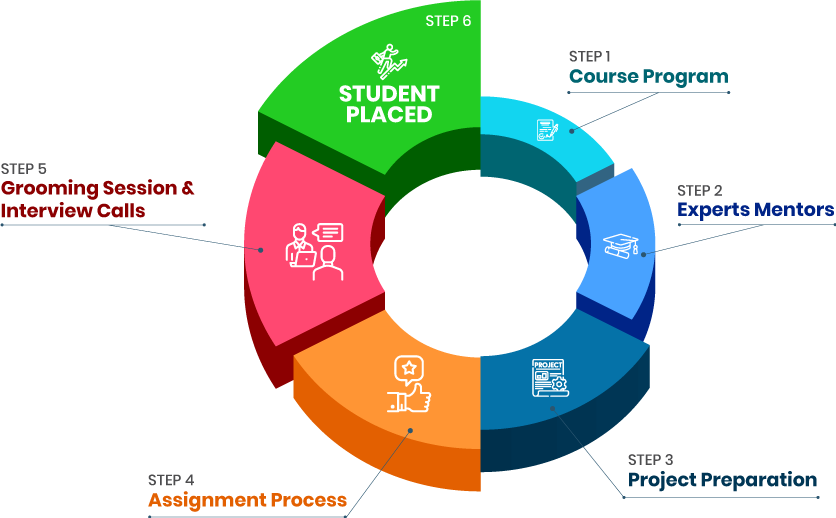

we train you to get hired.

By registering here, I agree to Croma Campus Terms & Conditions and Privacy Policy

+ More Lessons

Course Design By

Nasscom & Wipro

Course Offered By

Croma Campus

Stories

success

inspiration

career upgrade

career upgrade

career upgrade

career upgrade

You will get certificate after

completion of program

You will get certificate after

completion of program

You will get certificate after

completion of program

in Collaboration with

Empowering Learning Through Real Experiences and Innovation

we train you to get hired.

Phone (For Voice Call):

+91-971 152 6942WhatsApp (For Call & Chat):

+91-971 152 6942Get a peek through the entire curriculum designed that ensures Placement Guidance

Course Design By

Course Offered By

Ready to streamline Your Process? Submit Your batch request today!

No. You don’t need any SAP background. We start with the basics.

Yes! You’ll do practice projects that feel like real SAP implementations.

Yes. We help with resumes, interviews, and connect you with hiring companies.

Yes. Croma Campus certificates are accepted by companies in India and abroad. They prove your SAP FICO skills.

Highest Salary Offered

Average Salary Hike

Placed in MNC’s

Year’s in Training

fast-tracked into managerial careers.

Get inspired by their progress in the

Career Growth Report.

FOR QUERIES, FEEDBACK OR ASSISTANCE

Best of support with us

For Voice Call

+91-971 152 6942For Whatsapp Call & Chat

+91-9711526942